help unlock an offset

of 32-63% off

customers rides.

Cycle to work scheme New Zealand. NZ FBT exemption fringe benefit tax on electric bikes and e-bike benefit scheme. Workride NZ ride to work benefit. Tax savings. Free retailer benefit. Retailer partnership program

Our Retailer Partnership Program is not just a benefit.

It's a collaboration for mutual success.

a partnership where everyone wins.

Increase revenue by selling more bikes, parts and accessories!

Affordability is massively increased due to tax benefit and employer financing.

Retailer receives full-margin on parts, apparel, and services.

Increased opportunity to sell due to double store visit; quotation + pick-up.

Join 250+ bike shops and be circulated with 100,000*+ employees.

Workride commission is based on the quoted ride price only.

how it works.

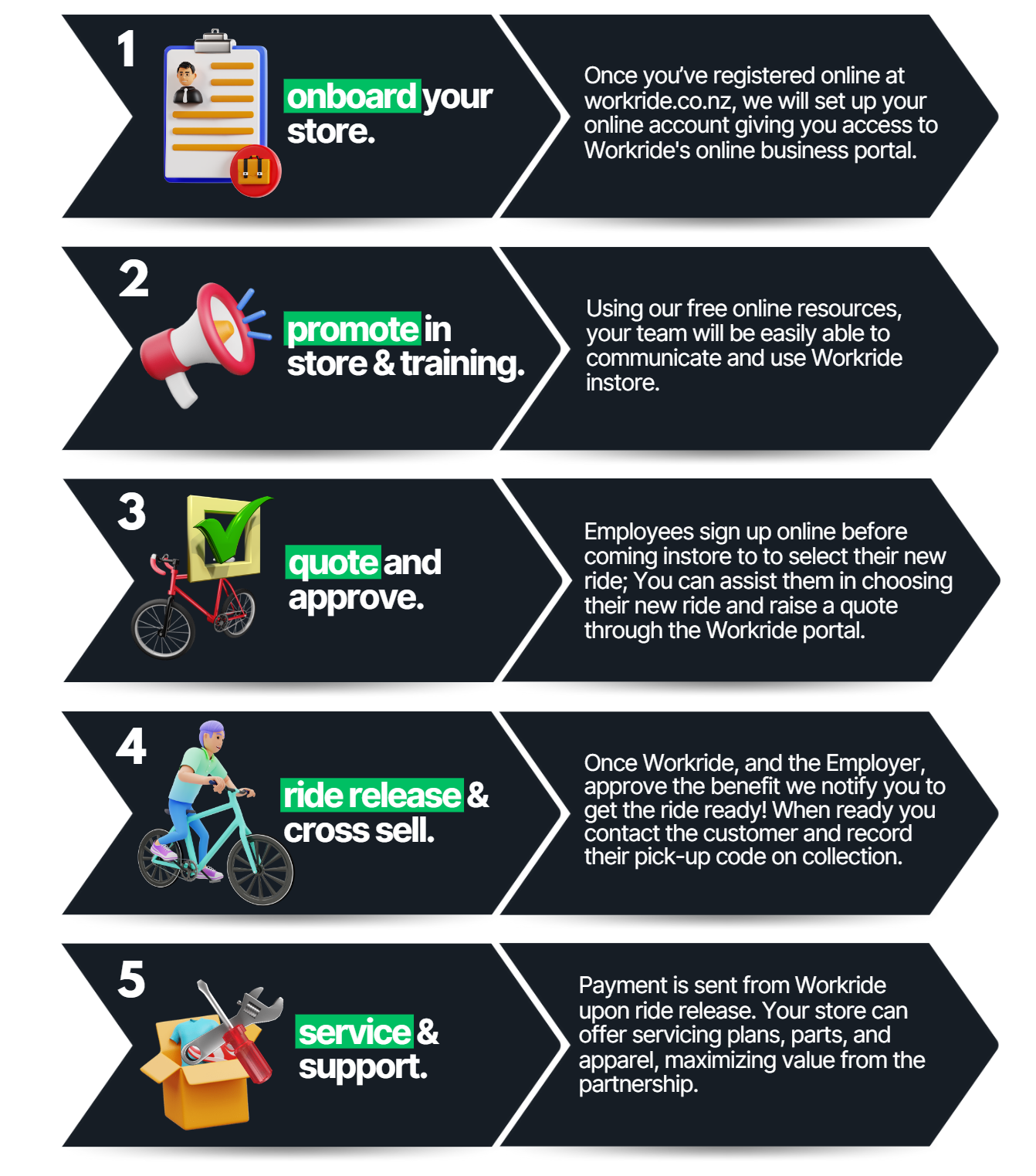

An employee from a Workride-partnered employer visits your store and you raise a quote for their desired "WorkRide" on our B2B Portal. Once approved by the employer, the employee collects the ride, and Workride covers the cost of the equipment, minus our partner commission.

On collection, retailers have the opportunity to offer additional services such as servicing plans, parts, and apparel, maximizing the value of the partnership.

Partnered with 98% of all bike stores nationwide.

workride retail process.

As a retailer, partnering with Workride offers you the opportunity to boost revenue through upselling or by lowering the barriers to purchase. Customers benefit from significantly reduced cost impact on rides, while you retain most of the original sales price. Additionally, customers will continue to rely on your store for parts, apparel, and servicing.

check your savings.

Use our free online savings estimator to see the impact of Workride for your customers.

Cost offsets range from 32-63% off the in-store quoted price to Workride, determined by your personal income situation. Workride offers a fantastic way to double down on savings.

join the retail partnership program.

Register your details to join the waitlist. One of the Workride team will be in touch to onboard your store when ready.

example of workride in store.

Our Retailer Partnership Program is not just a benefit—it's a collaboration for mutual success. As a retail partner, you're an essential part of the Workride family and our growth strategy. By reducing the effective cost of rides for customers, we're collectively fueling industry growth and encouraging more people to embrace riding.

we make it simple.

The B2B portal serves as your comprehensive online administration tool, offering a secure platform to manage all aspects of your Workride partnership. From this portal, you can:

Generate and submit quotes for customer rides

Approve ride benefits in real-time

Monitor the status of all your Workride orders

Access valuable resources and support

your customer can choose any ride.

Check out the details below to get up to speed with what rides are eligible for the WorkRide benefit scheme. This guide is in line with the guidance and regulations from the NZ Government, IRD, and Waka Kotahi.

-

Any bike that is suited for your commuting needs.

-

Any electric bike that the combined maximum power output of the electric auxiliary propulsion motors does not exceed 300 Watts, and is best suited for your commuting needs.

https://www.nzta.govt.nz/vehicles/vehicle-types/low-powered-vehicles -

Any e-scooter that has wheels smaller than 355mm in diameter, and that the combined maximum power output of the electric auxiliary propulsion motors does not exceed 300 Watts.

https://www.nzta.govt.nz/vehicles/vehicle-types/low-powered-vehicles -

The intent of this scheme is to enable access to ride hardware that allows the employee to ride to and from work. It is noted that their will be some incidental personal use, which is perfectly fine due to the health and active transport benefits for NZ.

-

Workride carries out a regulation check on every ride benefit raised to ensure fair use and compliance on the above guidelines.

how your customers save.

Workride operates on a "salary sacrifice" model, where employees opt to reduce their pre-tax salary to lease a bike or scooter. This reduction is reflected as a line item on their payslip. In addition to the salary, a small proportion of other contributions like student loans or KiwiSaver may also be redirected towards the ride, depending on its value. At the conclusion of the 12-month lease of the ride equipment, participating individuals will receive an email directly from Workride outlining their ‘Next steps’ options regarding ownership of the ride equipment.

For example, an employee with a $85,000 salary chooses a Trek Powerfly FS valued at $6380, but it’s on sale in-store at $5200.

Through Workride, they sacrifice $100 pre-tax and their weekly take-home pay impact is only reduced by $49, totalling an annual contribution of only $2572 towards the ride. This arrangement benefits both the employee and employer, offering tax savings and financial flexibility.

retailer FAQs.

Have a question that isn’t answered here?

Contact us by click the button below.

-

With Workride, you can offer compelling discounts to customers, but still retain most of your original sale price, making it easier to close sales. As a partner, you'll be showcased on our store map, reaching approved customers from small businesses to large organizations across New Zealand. Best of all, there's no upfront cost to become a partner store; Workride only charges when successful sales occur.

-

Partnering with Workride involves minimal costs to you as a retailer. There is no upfront fee to join the program. However, there is a success fee for each transaction processed through WorkRide to cover administrative and platform costs. Additionally, while Workride promotes partners and brings in customers, retailers are still responsible for their own in-store operational expenses. Any promotional or discount offers specific to Workride customers will also be at the discretion and cost of the retailer. It's essential to review the full Agreement to understand any other potential financial implications or commitments.

-

Upon an employee's selection of equipment from the retailer through the Workride platform, the retailer provides a quotation for the chosen product. Once WorkRide approves the quote, a purchase order (PO) is issued to the retailer. When the employee presents a collection certificate and approved photo ID at the retailer's location, the retailer verifies these through the WorkRide platform before handing over the equipment. Subsequently, the retailer invoices WorkRide for the equipment at the previously quoted price. The payment made by WorkRide to the retailer for the invoice finalizes the ownership transfer of the equipment to WorkRide, but the retailer retains risk until the equipment is in the employee's hands.

-

Signing up as a partner is a streamlined process. Typically, after submitting the required documentation and meeting the necessary criteria, approval can be obtained within 5-7 business days.

-

Yes, partners will be provided with Workride branded point-of-sale materials to display in-store. This includes banners, posters, and informational brochures to help promote the partnership and inform customers about the benefits of Workride.

-

Absolutely! Workride offers comprehensive training tools and resources to ensure that retailers are well-equipped to handle customer inquiries and promote the scheme effectively. This includes online tutorials, training manuals, and additional support if required. For further support and advice please contact the Retail Team at support@workride.co.nz

-

Once onboarded as a partner, you'll receive continuous support from the WorkRide team. This includes access to our support hotline, periodic training sessions, marketing assistance, and any updates or changes to the program.

-

No, partnering with WorkRide does not impose any exclusivity requirements. Retailers are free to collaborate with other brands or initiatives while benefiting from the partnership with Workride.

-

Absolutely! Retailers are encouraged to offer promotions or discounts to Workride customers. This not only attracts more customers but also strengthens the partnership between Workride and the retailer.

-

Workride has a dedicated customer service team to handle any disputes or issues. In case of a dispute, the team will collaborate with the retailer to ensure a swift and satisfactory resolution for all parties involved.

-

The purchasing price from Workride to the retailer remains static, based on the initial quote when the order was placed. For tax compliance reasons, we can't alter the ride's price without initiating a new order process. If there's a substantial price variation, the customer has the option to cancel the original order and re-quote the ride at the updated price, but this will postpone the collection timeframe.

-

Per our Retailer service agreement, the employee can cancel their order before using their pick-up code in-store. In such instances, neither Workride nor the Employee are liable for costs the retailer incurred up to that point in arranging the order. To reduce the risk of unnecessary expenses for retailers, Workride only issues the Purchase Order once payment is secured from the employer. This ensures all ride order formalities, including payment, are complete with the sole remaining step being the customer's pick-up. While there might be rare instances where the retailer incurs costs due to cancellations, we will assess these situations individually and refine our processes if needed.

-

Yes, if a customer has mistakenly chosen the wrong size or colour, they can exchange it for the correct one without restarting the entire order process. However, this is applicable only if the model and the price remain consistent with the original order.

-

Customers can cancel their order anytime prior to using their pickup code. If an order is cancelled, we'll inform you promptly. To change the selected ride under the Workride scheme, the customer must cancel their current order and initiate a new quote. This restarts the acquisition process, ensuring the newly selected ride adheres to our compliance and regulation standards.